Vertice, Consortium Zenith terminate RM815 mil Penang mega infrastructure contract.

SOURCE: theedgemarkets.com December 29, 2021 19:55 pm

By Kamarul Azhar. Edited by S Kanagaraju

KUALA LUMPUR (Dec 29): Construction group Vertice Bhd and Consortium Zenith Sdn Bhd have mutually agreed to terminate the Package 2 contract of the Penang Mega Infrastructure Project.

The contract, awarded by Consortium Zenith to Buildmarque Construction Sdn Bhd in August 2018, was for the construction of a by-pass connecting Bandar Baru Ayer Itam and the Tun Dr Lim Chong Eu Expressway in Penang, for a contract value of RM815 million.

Buildmarque is a 50:50 joint venture between Vertice’s wholly-owned unit Vertice Construction Sdn Bhd and Vizione Construction Sdn Bhd, a wholly-owned subsidiary of Vizione Holdings Bhd.

In a filing with Bursa Malaysia, Vertice said the acceptance of the letter of award (LOA) for the project was conditional upon Consortium Zenith receiving a written declaration from Buildmarque of its financial abilities to undertake the project.

Buildmarque had been in discussion with a financial institution to procure project financing worth RM295 million for the construction of the project. However, for Buildmarque to secure the project financing, Consortium Zenith must also secure its own project financing.

In April 2020, Buildmarque, while still in discussion with a financial institution for the project financing, reiterated to Consortium Zenith that the project financing is subject to the execution of sale and purchase agreement between the latter and identified land buyers for the exchanged lands.

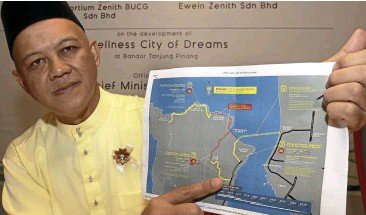

The exchanged lands refer to the 110 acres of land in Tanjung Pinang owned by the Penang state government. The state government intends to utilise the lands it owns there to finance the RM6 billion mega infrastructure project.

Consortium Zenith could not secure project financing from the same financial institution that Buildmarque was in discussion with to fund the Penang Mega Infrastructure Project. This then led to Buildmarque also not being able to secure its project financing for the by-pass.

Buildmarque had been in discussions with a financial institution to procure project financing from November 2019 until Jan 19, 2021, and the financial institution had provided two indicative term sheets, according to Vertice’s filing.

“Vertice also wishes to clarify that based on Vertice’s/Buildmarque’s understanding prior to acceptance of the award, Consortium Zenith had in December 2018 procured an overall financing arrangement with the same financial institution.

“The project financing was to be an extension to the overall financing structure offered by the financial institution to Consortium Zenith, where the financial institution would identify buyers for the exchanged lands as well as provide the project financing,” said Vertice.

The said overall financing arrangement expired in December 2020.

Status of early work done

Nevertheless, early works of the by-pass project had commenced in September 2019, funded by the shareholders of Buildmarque. The total cost of the early works was agreed between Buildmarque and Consortium Zenith to be RM25 million.

In September 2020, Buildmarque sought updates from Consortium Zenith with regards to the status of outstanding payment for the early work done and interim certificates for the total cumulative amount of seven payment certificates, with a total sum of RM5.86 million.

Buildmarque further sought confirmation from Consortium Zenith in respect of the status of the exchanged lands and the following ancillary documents which shall be the pre-requisite documents for Buildmarque to procure the project financing.

The ancillary documents include the sale and purchase agreement between Consortium Zenith and identified land buyers for the exchanged lands, and tripartite agreement between Consortium Zenith, China Railway Construction Company Ltd (CRCC) and Buildmarque.

Consortium Zenith explained to Buildmarque that the payments due to the company are dependent on the monetisation of the exchanged lands, and Consortium Zenith has not received the relevant letters from the Penang state government to commence the land alienation for the exchanged lands.

As both parties were stuck with financing, in March 2021 discussions were commenced to mutually terminate the LOA.

Impact on future earnings

In view that the contract sum was RM815 million, Vertice stated in its filing that the mutual termination would have a material impact on the future earnings of the group.

“As a result of the mutual termination, Buildmarque will not be able to recognise further earnings, if any, from the contract works of Package 2 project.

“Correspondingly, Vertice will not be able to recognise its future share of earnings, if any, in Buildmarque,” the group stated.

Upon the execution of the deed and the termination of the LOA, Vertice stated that Consortium Zenith covenants and undertakes with Buildmarque that it shall refund all deposits paid and reimburse Buildmarque for all the claims for the work done.

Buildmarque had paid RM8 million in deposits to Consortium Zenith for the project. Consortium Zenith will reimburse the deposits in four tranches within 24 months of the execution of the deed.

In respect of progress claim, the amounts are subject to be verified by the Penang government or a professional quantity surveyors’ firm. The assessment by the parties shall be completed within two months from the date of the deed, or an extension of time mutually agreed by the parties.

Consortium Zenith is to pay the progress claim amount to Buildmarque via three tranches of half-yearly instalments, with the first instalment to be commenced within six months from the date the amount is verified.

Vertice holds a 12.05% stake in Consortium Zenith, making the project a related party transaction. Other shareholders include Zenith Construction Sdn Bhd (78.49%), Manhattan Premier Sdn Bhd (8.78%) and Juteras Sdn Bhd (0.68%).

The RM6.3 billion project comprises four construction work packages, including three toll-free highways on the island and an undersea tunnel between Butterworth and Gurney Drive.

Vertice’s share price closed at 22 sen on Wednesday, valuing the group at RM59 million. Meanwhile, Vizione’s share price closed at eight sen, giving a market capitalisation of RM87 million.

Be the first to comment